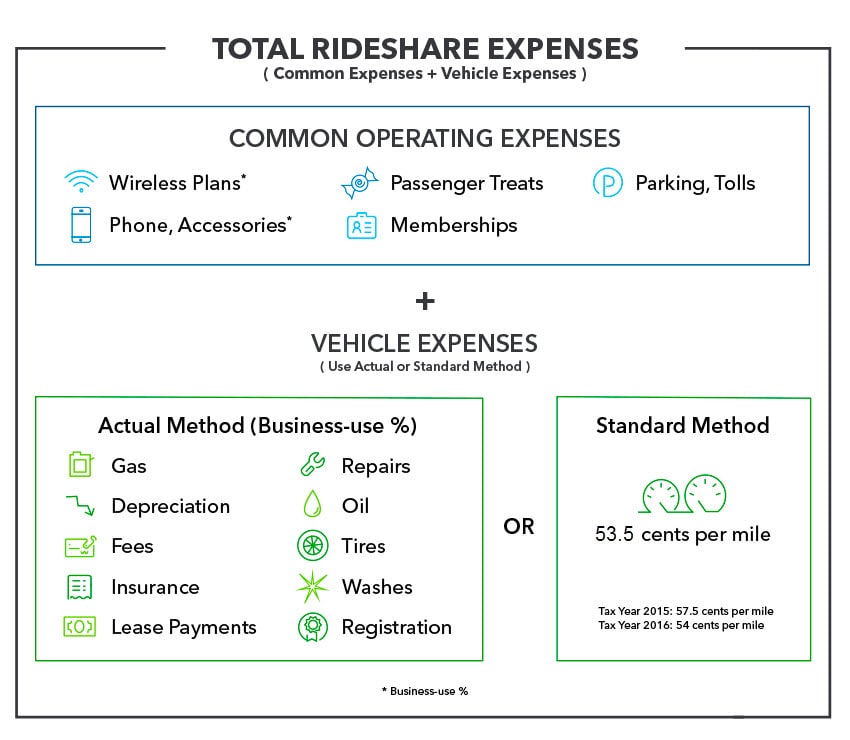

Taxpayers have two options to calculate car-related expenses:

- standard mileage rate

- must not operate 5 or more cars at the same time

- must not have claimed depreciation deduction other than straight-line method

- must not have claimed section 179

- must not have claimed special depreciation allowance

- must not have claimed actual expenses after 1997 for a leased car

- cannot be a rural mail carrier who received a qualified reimbursement

- actual expense

Changing Methods

- you may switch from standard mileage rate to actual expense. But you must then use straight-line depreciation. The new basis is the cost minus the depreciation portion allowed in standard mileage rate.

- However, switching from actual expense to standard mileage rate must satisfy all the above requirements, which normally it is a BIG no.

Publication 463